HOPE. ACTION. LEVERAGE.

Tesdorpfsvej 35B - 2000 Frederiksberg - Denmark

Impact Report Nordic Investors 2020 is the second market analysis of intentions, approaches and activities among early stage investors in the Nordic region investing in green tech and other sustainable solutions.

We see this year an expansion of intentions and activities.

88 % of the respondents have answered that impact investing is very important to them. At the same time geography, causes, industries and solutions are becoming more and more diversified.

The trend is clear. The market for impact investing is growing in both depth and sophistication. 67% of the investors say that they expect to increase their impact investments.

Compared to last year’s focus – why, how, what and where do you invest with impact? – with this year’s survey we also sought to understand the behaviour, motivation and the outcome related to investing in impact.

Download ‘Impact Report Nordic Investors 2020’ here or flip through it below.

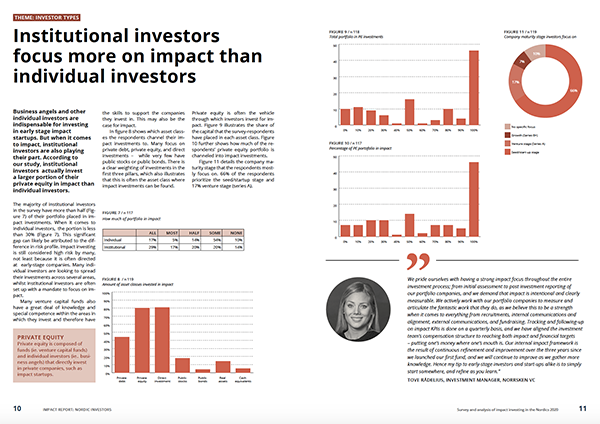

Most investors find impact investing important to them. It provides good opportunities and return and they expect to increase allocation of capital for impact.

More than half of the investors think that both financial returns and the positive impact on the world in their impact portfolio are in line with or outperforming their expectations.

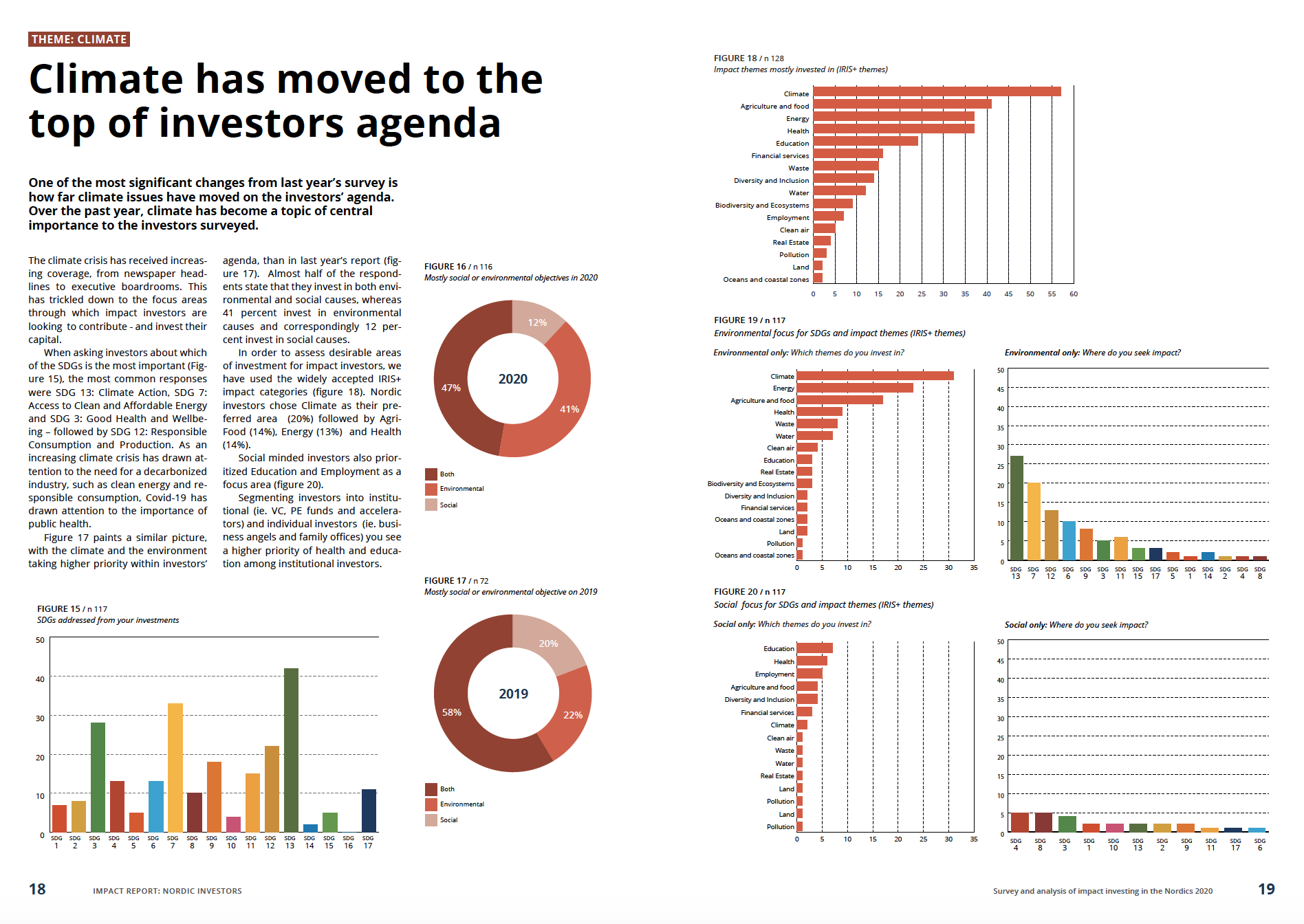

This year the climate has moved up the impact investing agenda. Investors focus on environmental causes (e.g. agri-food and energy) more than social causes (eg. health and education). SDG 13: Climate Action is highest on the agenda.

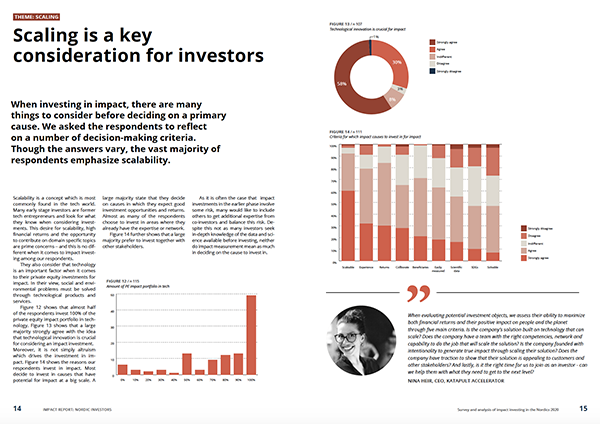

Investors value technology as a strong driver for impact.

Most invest in seed (startup stage) and series A (venture stage) for impact.

They decide on causes where they see scalability and where they can contribute with experience and find co-investors.

And they provide patient capital for a longer hold period than normal.

Together with Bootstrapping, a leading media in the startup-investor ecosystem, we have prepared 6 relevant articles for all of you that would like to get wiser on impact investing.

Enjoy.

#1: Where do Nordic investors go from here?

#2: Climate has moved to the top of the investors’ agenda.

#3: Scaling is just one way to achieve a longterm postive impact.

#4: Personal motivation is a key driver for impact investing.

#5: How do you manage and measure your impact investments?

#6: Don’t let perfection become the barrier to take action as an impact investor.

HOPE. ACTION. LEVERAGE.

Tesdorpfsvej 35B - 2000 Frederiksberg - Denmark